I am trying to solve the following inequality constraint:

Given time-series data for N stocks, I am trying to construct a portfolio weight vector to minimize the variance of the returns.

the objective function:

min w^{T}\sum w

s.t. e_{n}^{T}w=1

\left \| w \right \|\leq C

where w is the vector of weights, \sum is the covariance matrix, e_{n}^{T} is a vector of ones, C is a constant. Where the second constraint (\left \| w \right \|) is an inequality constraint (2-norm of the weights).

I tried using the nloptr() function but it gives me an error: Incorrect algorithm supplied. I'm not sure how to select the correct algorithm and I'm also not sure if this is the right method of solving this inequality constraint.

I am also open to using other functions as long as they solve this constraint.

Here is my attempted solution:

data <- replicate(4,rnorm(100))

N <- 4

fn<-function(x) {cov.Rt<-cov(data); return(as.numeric(t(x) %*%cov.Rt%*%x))}

eqn<-function(x){one.vec<-matrix(1,ncol=N,nrow=1); return(-1+as.numeric(one.vec%*%x))}

C <- 1.5

ineq<-function(x){

z1<- t(x) %*% x

return(as.numeric(z1-C))

}

uh <-rep(C^2,N)

lb<- rep(0,N)

x0 <- rep(1,N)

local_opts <- list("algorithm"="NLOPT_LN_AUGLAG,",xtol_rel=1.0e-7)

opts <- list("algorithm"="NLOPT_LN_AUGLAG,",

"xtol_rel"=1.0e-8,local_opts=local_opts)

sol1<-nloptr(x0,eval_f=fn,eval_g_eq=eqn, eval_g_ineq=ineq,ub=uh,lb=lb,opts=opts)

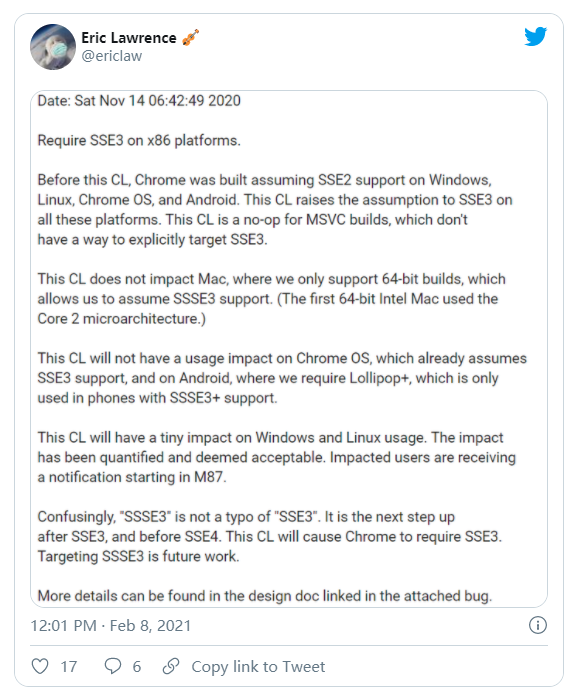

This looks like a simple QP (Quadratic Programming) problem. It may be easier to use a QP solver instead of a general purpose NLP (NonLinear Programming) solver (no need for derivatives, functions etc.). R has a QP solver called quadprog. It is not totally trivial to setup a problem for quadprog, but here is a very similar portfolio example with complete R code to show how to solve this. It has the same objective (minimize risk), the same budget constraint and the lower and upper-bounds. The example just has an extra constraint that specifies a minimum required portfolio return.

Actually I misread the question: the second constraint is ||x|| <= C. I think we can express the whole model as:

This actually looks like a convex model. I could solve it with "big" solvers like Cplex,Gurobi and Mosek. These solvers support convex Quadratically Constrained problems. I also believe this can be formulated as a cone programming problem, opening up more possibilities.

Here is an example where I use package cccp in R. cccp stands for

Cone Constrained Convex Problems and is a port of CVXOPT.

The 2-norm of weights doesn't make sense. It has to be the 1-norm. This is essentially a constraint on the leverage of the portfolio. 1-norm(w) <= 1.6 implies that the portfolio is at most 130/30 (Sorry for using finance language here). You want to read about quadratic cones though. w'COV w = w'L'Lw (Cholesky decomp) and hence w'Cov w = 2-Norm (Lw)^2. Hence you can introduce the linear constraint y - Lw = 0 and t >= 2-Norm(Lw) [This defines a quadratic cone). Now you minimize t. The 1-norm can also be replaced by cones as abs(x_i) = sqrt(x_i^2) = 2-norm(x_i). So introduce a quadratic cone for each element of the vector x.