I have a large data frame, df, containing 4 columns:

id period ret_1m mkt_ret_1m

131146 CAN00WG0 199609 -0.1538 0.047104

133530 CAN00WG0 199610 -0.0455 -0.014143

135913 CAN00WG0 199611 0.0000 0.040926

138334 CAN00WG0 199612 0.2952 0.008723

140794 CAN00WG0 199701 -0.0257 0.039916

143274 CAN00WG0 199702 -0.0038 -0.025442

145754 CAN00WG0 199703 -0.2992 -0.049279

148246 CAN00WG0 199704 -0.0919 -0.005948

150774 CAN00WG0 199705 0.0595 0.122322

153318 CAN00WG0 199706 -0.0337 0.045765

id period ret_1m mkt_ret_1m

160980 CAN00WH0 199709 0.0757 0.079293

163569 CAN00WH0 199710 -0.0741 -0.044000

166159 CAN00WH0 199711 0.1000 -0.014644

168782 CAN00WH0 199712 -0.0909 -0.007072

171399 CAN00WH0 199801 -0.0100 0.001381

174022 CAN00WH0 199802 0.1919 0.081924

176637 CAN00WH0 199803 0.0085 0.050415

179255 CAN00WH0 199804 -0.0168 0.018393

181880 CAN00WH0 199805 0.0427 -0.051279

184516 CAN00WH0 199806 -0.0656 -0.011516

id period ret_1m mkt_ret_1m

143275 CAN00WO0 199702 -0.1176 -0.025442

145755 CAN00WO0 199703 -0.0074 -0.049279

148247 CAN00WO0 199704 -0.0075 -0.005948

150775 CAN00WO0 199705 0.0451 0.122322

etc.

I am attempting to calculate a common financial measure, known as beta, using a function, that takes two of the columns, ret_1m, the monthly stock_return, and ret_1m_mkt, the market 1 month return for the same period (period_id). I want to apply a function (calc_beta) to calculate the 12-month result of this function on a 12 month rolling basis.

To do this, I am creating a groupby object:

grp = df.groupby('id')

What I would like to do is use something like:

period = 12

for stock, sub_df in grp:

arg = sub_df[['ret_1m', 'mkt_ret_1m']]

beta = pd.rolling_apply(arg, period, calc_beta, min_periods = period)

Now, here is the first problem. According to the documentation, pd.rolling_apply arg can be either a series or a data frame. However, it appears that the data frame I supply is converted into a numpy array that can only contain one column of data, rather than the two I have tried to supply. So my code below for calc_beta will not work, because I need to pass both the stock and market returns:

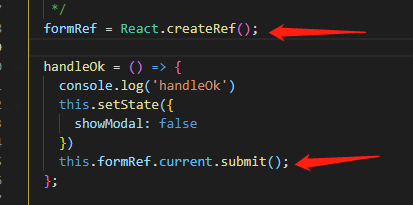

def calc_beta(np_array)

s = np_array[:,0] # stock returns are column zero from numpy array

m = np_array[:,1] # market returns are column one from numpy array

covariance = np.cov(s,m) # Calculate covariance between stock and market

beta = covariance[0,1]/covariance[1,1]

return beta

So my questions are as follows, I think it makes sense to list them in this way:

(i) How can I pass a data frame/multiple series/numpy array with more than one column to calc_beta using rolling_apply?

(ii) How can I return more than one value (e.g. the beta) from the calc_beta function?

(iii) Having calculated rolling quantities, how can I recombined with the original dataframe df so that I have the rolling quantities corresponding to the correct date in the period column?

(iv) Is there a better (vectorized) way of achieving this? I have seen some similar questions using e.g. df.apply(pd.rolling_apply,period,??) but I did not understand how these worked.

I gather that rolling_apply previously was unable to handle data frames, but the documentations suggests that it is now able to do so. My pandas.version is 0.16.1.

Thanks for any help! I have lost 1.5 days trying to figure this out and am totally stumped.

Ultimately, what I want is something like this:

id period ret_1m mkt_ret_1m beta other_quantities

131146 CAN00WG0 199609 -0.1538 0.047104 0.521 xxx

133530 CAN00WG0 199610 -0.0455 -0.014143 0.627 xxxx

135913 CAN00WG0 199611 0.0000 0.040926 0.341 xxx

138334 CAN00WG0 199612 0.2952 0.008723 0.567 xx

140794 CAN00WG0 199701 -0.0257 0.039916 0.4612 xxx

143274 CAN00WG0 199702 -0.0038 -0.025442 0.215 xxx

145754 CAN00WG0 199703 -0.2992 -0.049279 0.4678 xxx

148246 CAN00WG0 199704 -0.0919 -0.005948 -0.4225 xxx

150774 CAN00WG0 199705 0.0595 0.122322 0.780 xxx

153318 CAN00WG0 199706 -0.0337 0.045765 0.623 xxx

id period ret_1m mkt_ret_1m beta other_quantities

160980 CAN00WH0 199709 0.0757 0.079293 -0.913 xx

163569 CAN00WH0 199710 -0.0741 -0.044000 0.894 xxx

166159 CAN00WH0 199711 0.1000 -0.014644 0.563 xxx

168782 CAN00WH0 199712 -0.0909 -0.007072 0.734 xxx

171399 CAN00WH0 199801 -0.0100 0.001381 0.894 xxxx

174022 CAN00WH0 199802 0.1919 0.081924 0.789 xx

176637 CAN00WH0 199803 0.0085 0.050415 0.1563 xxxx

179255 CAN00WH0 199804 -0.0168 0.018393 -0.64 xxxx

181880 CAN00WH0 199805 0.0427 -0.051279 -0.742 xxx

184516 CAN00WH0 199806 -0.0656 -0.011516 0.925 xxx

id period ret_1m mkt_ret_1m beta

143275 CAN00WO0 199702 -0.1176 -0.025442 -1.52 xx

145755 CAN00WO0 199703 -0.0074 -0.049279 -0.632 xxx

148247 CAN00WO0 199704 -0.0075 -0.005948 1.521 xx

150775 CAN00WO0 199705 0.0451 0.122322 0.0321 xxx

etc.